With the increasing volume of N-type modules such as TOPCon, the demand for high-performance POE film is rising rapidly, and POE particles are regarded as one of the most important auxiliary materials for photovoltaics in the next 1-2 years.

Minsheng Securities estimates that the current global supply of photovoltaic-grade POE particles is about 300,000-400,000 tons, which is far less than the demand for POE particles. In 2023, POE particles are expected to face a shortage, or become a bottleneck in the industrial chain.

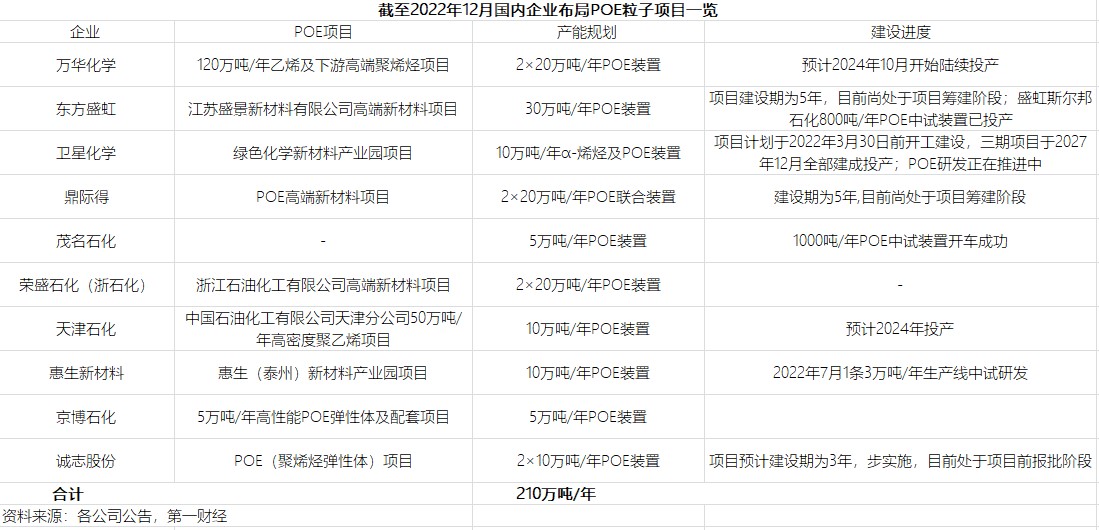

The production of POE particles has been monopolized overseas so far, and there are still many difficulties in localization. However, leading chemical companies such as Wanhua Chemical and Satellite Petrochemical have announced new POE production capacity. The industry predicts that in 2024, POE particles are expected to achieve a breakthrough in localized mass production, and the first companies to launch the market will enjoy industry dividends; after 2026, the production capacity of many domestic companies will be launched, and the POE particle market may become a red sea.

POE particle supply guarantee is the key in 2023

POE film has the characteristics of high barrier property, strong anti-PID ability, and no acetic acid. It is currently the main packaging film for double-sided modules and N-type batteries.

POE particles are the core upstream raw material of POE film, and the cost of particles accounts for more than 80% of the total production cost of photovoltaic film. Haitong Securities estimates that the demand for photovoltaic POE from 2022 to 2025 will be 190,000/450,000/750,000/1.03 million tons respectively, and the supply of POE particles will be tight.

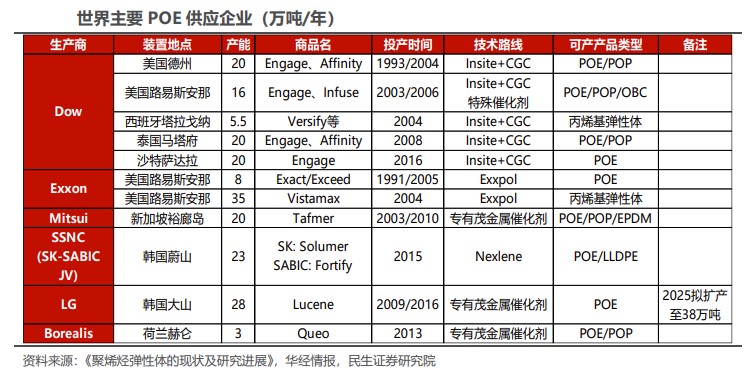

At present, there is no large-scale mass production of POE particles in China. Dow (Dow's global POE production capacity will account for 48% in 2021), Mitsui, and LG are the world's major suppliers of POE particles, with strong bargaining power, and the payment method is usually cash.

From 2017 to 2021, my country's POE import volume increased from 222,200 tons to 639,900 tons, with an average annual compound growth rate of 29.95%; the import unit price rose from 1,615.75 US dollars/ton in 2020 to 2,843.19 US dollars/ton from January to July 2022 , an increase of 75.97%.

According to the analysis of Southwest Securities Research Report, although the total production capacity of POE particles in the world has reached 2 million tons, because POE particles are widely used in automobiles, wires and cables, polymer modification and other fields, considering the actual capacity utilization rate and the growth in demand in other application fields, The actual production capacity of photovoltaic-grade POE particles is much lower than the nominal production capacity due to factors such as production line switching between different brands and different products.

You Jiaxun, chief analyst of the electrical equipment new energy industry of China Merchants Securities, believes that the short-term increase in POE particles for photovoltaic film may come more from the production capacity allocation of POE particle manufacturers. Considering the rapid release of downstream demand, particle supply is the key in 2023.

According to the new team of Minsheng Securities, Dow announced that in 2023, it will provide 200,000 tons of POE particles to Foster, 40,000 to 50,000 tons to Saiwu Technology, and the rest will be distributed to other manufacturers; Xiangbang Technology will basically cut off Mitsui’s POE Particle supply; POE particles of Haiyou New Material mainly come from LG Chem. Based on the fact that after 2020, the newly-added film production lines in China can simultaneously meet the production of EVA, POE, and EPE. Therefore, the "spectacle" of each film manufacturer is how many POE particles can be supplied.

There are three major barriers to domestic POE industrial production

The so-called POE mainly refers to ethylene-octene copolymer elastomers with a mass fraction of octene greater than 20%, which has a wide range of downstream applications and high production barriers.

Members of the team of Professor Jiang Tao from Tianjin University of Science and Technology pointed out that the POE synthesis technology mainly adopts the solution polymerization process, and foreign countries have a large number of patents in the field of catalysts and polymerization processes , and the relevant core technologies are not transferred to the outside world. Domestic universities and research institutes have conducted relevant research on POE synthesis technology, and developed metallocene catalysts and non-organometallic catalysts with high copolymerization performance, but the last mile path to industrialization has not yet been opened.

According to Chen Zikun, a senior analyst in the new field of GF Securities, there are three core issues in POE production: the first is the catalyst, and the development or matching of metallocene catalysts is the core issue. Due to the relative confidentiality of catalysts at present, most domestic production lines now use catalyst research methods, whether it is experimentation or industrial production, to purchase foreign catalysts at the initial stage, and then gradually develop them. At present, the research and development of metallocene catalysts and their catalytic products in my country mainly rely on units such as PetroChina and the Institute of Chemistry, Chinese Academy of Sciences. Most of the private enterprises outside the Sinopec system also have research institutes and research systems. They also purchase foreign catalysts first and add their own technical reserves to continuously improve and explore.

The second lies in α-olefins, which account for about 60% of the profits of the POE industry chain. The α-olefin raw materials required for POE mainly refer to raw materials such as octene and carbon 8. Due to the blockade of linear α-olefin technology by foreign companies and high technology transfer fees, my country needs to import a large amount of high-carbon α-olefins from abroad every year. However, according to statistics, the vast majority of manufacturers currently planning POE in China are equipped with α-olefin production capacity. Their technology has no problem, and they can be put into production simultaneously or successively with POE. In terms of subdivision, in the future, China's POE may be divided into carbon 4 POE and carbon 8 POE (currently planned α-olefin production capacity is mostly carbon 8).

The third is the POE process package. At present, Dow’s first-generation patent will expire. Through the research on POE process by domestic scientific research institutes and colleges, combined with the expiry of foreign patents, it can be applied, so there is basically no problem in POE process.

According to Chen Zikun, in descending order of difficulty, they are catalysts, α-olefins and POE polymerization. At present, the latter two parts have basically achieved technological breakthroughs in China, and there are still technical difficulties in catalysts.

The prospects for localization are broad, and major manufacturers are vying to deploy

At this stage, domestic POE has not yet achieved industrialized production, but major chemical companies such as Wanhua and Satellite have announced new POE production capacity, and the technology is self-developed.

According to the statistics of China Business News, as of December 2022, the planned production capacity of POE particles in China is about 2.1 million tons. Sheng Hong et al. For example, Satellite Chemical stated on the investor interaction platform on January 13 that the POE project independently developed by the company is being implemented, and the small-scale test products have been sent to downstream customers for testing. Among them, α-olefin, the core raw material of POE, has built a 1,000-ton/year plant and will be put into trial production soon.

UBS China petrochemical industry analyst Guo Yifan told China Business News that the civil construction of the POE particle project will take about 2 years, and it will take 0.5-1 year to debug qualified products after the handover, and the expansion cycle generally takes 3-3.5 years. According to the production capacity planning and project progress of each enterprise, taking into account the project test run and production capacity ramp-up, it is expected to achieve a breakthrough in localized mass production in 2024, and the enterprises that are the first to launch on the market will enjoy industry dividends.

A senior industry analyst who did not want to be named said that Wanhua’s POE photovoltaic materials have been released in pilot plants in 2022 and have been sent to downstream customers for verification. It takes a long time to do research in a specific environment, and the product demonstration has not yet been completed. There is no problem in terms of the physical properties of the POE particles of the product, which can meet the requirements of photovoltaic grade physical properties. Optimistically, assuming that there is no problem with the photovoltaic POE pilot test particles, Wanhua may start production in early 2024, and it will not have to wait until 2025 to industrialize the production of POE particles.

But the person also pointed out that from a neutral point of view, after all, there is currently no industrialized device in China, and the span from pilot test to industrialized device is relatively large. It is doubtful whether the current domestic technical reserves can realize the rapid production of qualified products by industrialized devices.

In view of the high price of photovoltaic POE, foreign suppliers are also more active in expanding production. According to comprehensive media reports, Mitsui expects to add 120,000 tons of POE production capacity, Sabic will expand its production capacity to 300,000 tons, and LG will expand its production capacity to 380,000 tons in the future. Therefore, foreign POE production capacity is expected to expand by 200,000 to 400,000 tons in the future. Ton.

The new team of Minsheng Securities expects that after 2026, the production capacity of many domestic companies will be launched, and the POE particle market may become a red sea by then.

Dingjide, which has recently become popular and spent tens of billions of dollars to "enter" the POE war, expressed optimism and was not worried about the change of POE volume. Insiders of the company believed that 10 years ago, people did not know that POE could be used in photovoltaics as a performance Very excellent products, POE has more products that can be replaced, such as replacing rubber, SEBS, SBS elastomers are all possible. In fact, POE can replace rubber, SEBS and SBS elastomers are all possible.

From the perspective of Dingjide's investment and construction projects, it is expected that the first phase of the plant will be completed in early 2025, and 300,000 tons of α-olefin and 200,000 tons of POE plants will be built at the same time. The company's α-olefin uses selective oligomerization technology, and the most critical metallocene catalyst is provided by the craftsman in the early stage. Considering cost reduction, the company plans to replace it with its own catalyst after it is put into production.

联系咨询

| Get exact prices For the country / regionE-mail: mail@yezhimaip.com |